Over the past several years (since the beginning of the Covid pandemic in early 2020), real estate lawyers in New Brunswick have experienced a huge increase in real property transactions. Many of these transactions have involved purchasers from other provinces that sold their homes for significant returns on their investments and purchased properties in New Brunswick for cash. Often, purchasers have not even viewed the properties in person prior to completing the transaction. In some cases, people have viewed a property by videoconferencing technology with their real estate agent. In other cases, purchasers have not viewed the property at all and complete the transaction sight unseen.

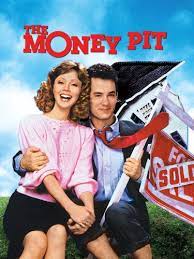

Purchasing a home without completing the proper due diligence can lead to all kinds of problems. In the 1986 movie, “The Money Pit,” Tom Hanks and Shelley Long purchased a property that turned out to be far more than they bargained for. We might have laughed at this movie, but there’s nothing funny about paying top dollar for a property only to find out that there are significant issues hiding behind the walls that will cost you more time, money and headaches than you could have ever imagined! Here are 5 ways that you can avoid purchasing your own version of the money pit:

-

Get a home inspection

A home inspection is one of the easiest ways to ensure peace of mind when purchasing a new home. For a reasonable fee, a property inspector will look through a home and provide you with a report about the issues that must be fixed and some of the issues that should be fixed. You may wish to negotiate with the vendors about the purchase price if they are unwilling to cover the costs of the required repairs. Here are some links to local property inspectors that our clients often use:

- Adam Anderson – A Buyer’s Choice Home Inspections Fredericton (abuyerschoice.com)

- Capstone Property Advisors Inc in Woodstock, NB | 5063245697 | 411.ca

- (1) MJM Home Inspections | Florenceville-Bristol NB | Facebook

-

Say no to “as is where is”

Many people have purchased properties on an “as is where is” basis over the past several years. This is okay if you are willing to be responsible for any repairs required or issues that arise. However, when you purchase a property on an “as is where is” basis, you are releasing the Vendors from responsibility for most defects. The doctrine of caveat emptor (“let the buyer beware”) typically applies to defects that are not visible. There are some small exceptions to this real in cases of fraud, for example, but we recommend saying no to “as is where is” purchases whenever possible.

-

Visit the property in person (if possible)

We have seen many people over the past several years purchasing properties either sight unseen or only viewing the properties by video conferencing technology. We recommend visiting the property in person and using a checklist to review common property issues. Better yet, you can avoid many issues with a property if you combine a personal visit with an inspection in #1 above. Here is a link for a free home inspection checklist The Ultimate Home Inspection Checklist for Buyers (with Printable PDF) | REW

-

Ask for (and review) a Property Disclosure Statement

You will typically receive a property disclosure statement when you are purchasing a property through a real estate agent. There is usually a box you check that states that you “require a property disclosure statement”. This statement has questions regarding defects of which the Vendor may be aware. The answers are typically “yes”, “no”, “n/a” format with an opportunity for the vendor to expand on certain answers. These forms have questions about the foundation, water leaking, roof repairs, electrical, etc. It is important to closely review this disclosure statement and to ask your lawyer and/or real estate agent any questions you may have. If you find latent defects to the property (defects that could not be discovered through ordinary due dilligence) that the vendor did not disclose, you may be able to make a claim against the vendor for misrepresentation and damages to assist you with repairs to the home.

-

Prepare a list of questions to ask your lawyer at the time of closing

Finally, you should prepare a list of questions to discuss with your lawyer at the time of closing. Some important items that I always like to review with clients;

- What does the map look like online? Does it match up with what you thought you were purchasing? Does it match the description in a historical deed?

- Is there a subdivision plan that provides detailed dimensions for the land?

- Are there any easements on the property? If so, what rights does the easement holder have? (i.e. can they merely walk over the property to get to another property? Is there a shared driveway? Is there an easement to cut wood on the property or access a well or spring?)

- Do you plan on possibly operating a business out of the property? Have you checked to ensure the property is appropriately zoned, so that you can do what you want without getting flak from the municipality or neighbours?

As the saying goes: there are no stupid questions. I am always appreciative when clients who attend a meeting to sign closing documents are engaged and ask a lot of questions. I hope you find these suggestions helpful! As always, if you have further questions or wish to schedule a consult, please contact us at 506-325-3333.